Get the free mwcpf

Show details

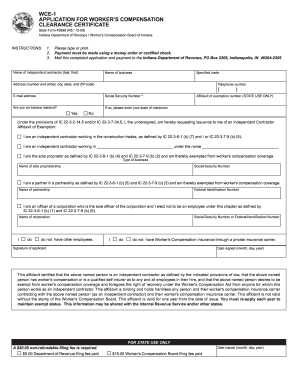

MICHIGAN APPLICATION FOR WORKERS COMPENSATION INSURANCE MICHIGAN WORKERS COMPENSATION PLACEMENT FACILITY MAIL: P.O. Box 3337, Livonia, MI 48151-3337 EXPRESS MAIL AND VISITORS: 17197 N. Laurel Park

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign michigan workers compensation forms

Edit your michigan workers compensation application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your workers comp application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing michigan workers' compensation forms online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit workers' compensation forms. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

workers comp application form

: Try Risk Free

People Also Ask about application for workers compensation form

What happens if I get fired while on workers comp in Michigan?

If your employer terminates your job while you are on workers' compensation, you don't lose your benefits until the time when you would have returned to work. These benefits continue so long as you meet the state's disabled definition, which could be for the rest of your life.

How long can you collect workers compensation in Michigan?

ing to Michigan law, a person can stay on workers' comp for their entire lifetime. Medical treatment should be covered indefinitely provided it is reasonable, necessary, and related. Wage loss benefits are paid so long as a person remains disabled and is actively in the workforce.

What is the Workers disability compensation Act in Michigan?

The Michigan Workers' Disability Compensation Act (Act) established protections for workers who get sick or injured from the work they do. It makes benefits available to most workers regardless of who is at fault for the injury or illness.

Who is required to have workers compensation insurance in Michigan?

Chances are, your Michigan business is required to have workers' compensation insurance. You'll need workers' comp if you have three or more employees, or one employee working more than 35 hours per week for 13 weeks or longer. Both public and private employers need Michigan workers' compensation coverage.

Does my employer have to hold my job while on workers comp in Michigan?

There is nothing in the Michigan workers' compensation law that protects your employment.

What happens if you quit your job while on workers comp in Michigan?

However, under Michigan's workers' compensation law, if you take a new job in this situation, which means quitting your current one, your wage loss benefits will stop.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete basic manual online?

Easy online ucango2 college term word search completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit michigan work comp placement facility online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your mwcpf form and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

How do I complete mwcpf form on an Android device?

Complete your mwcpf form and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is mwcpf?

MWCPF stands for 'Monthly Wage Cost Payroll Form,' which is used for reporting wage-related expenses for employees.

Who is required to file mwcpf?

Employers who have employees working within a specific jurisdiction and need to report wage costs to the appropriate government authority are required to file MWCPF.

How to fill out mwcpf?

To fill out the MWCPF, employers need to enter details such as employee names, wages paid, hours worked, and any applicable deductions in the designated fields on the form.

What is the purpose of mwcpf?

The purpose of the MWCPF is to ensure accurate reporting of employee wage costs for compliance with labor laws and to facilitate proper tax assessments.

What information must be reported on mwcpf?

The information that must be reported on MWCPF includes employee names, total wages paid, hours worked, tax withholdings, and any deductions or contributions related to payroll.

Fill out your mwcpf form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mwcpf Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.